[ad_1]

On-chain data suggests that whales are accumulating large amounts of Maker (MKR) and Aave (AAVE), two leading decentralized finance (DeFi) tokens. This accumulation trend coincides with a broader cooling-off period in the crypto scene days after the United States Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs.

Whales Accumulate MKR And AAVE

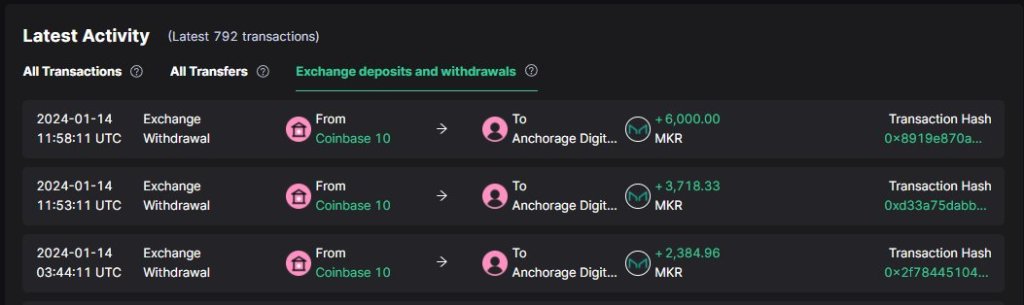

According to ScopeScan data, Anchorage Digital, a digital asset custody firm, purchased a significant amount of MKR on January 15. The firm acquired 12,103 MKR tokens, valued at approximately $24.7 million, from Coinbase, a leading crypto exchange in the United States.

Two whales, “0xbb5f” and “0x4a7,” also accumulated large quantities of MKR and AAVE. Specifically, “0xbb5f” bought 50,000 AAVE and 2,452 MKR worth around $5.03 million and $4.95 million from Binance, a leading cryptocurrency exchange. Meanwhile, 0x4a7 purchased 39,000 AAVE and 2,350 MKR, valued at approximately $3.95 million and $4.75 million, also from Binance.

These whale purchases signal a strong belief in the long-term potential of MKR and AAVE. Maker and Aave are two of the world’s leading decentralized lending and borrowing protocols across DeFi. MKR serves as the governance token for MakerDAO, which also manages the DAI decentralized stablecoin. On the other hand, AAVE is the governance token of Aave, a top decentralized lending platform.

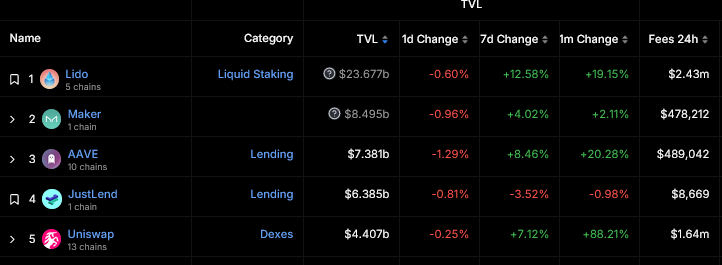

According to the latest DeFiLlama data, Maker and Aave have total value locked (TVL) of over $8.4 billion and $7.3 billion, respectively.

Notably, whales are accumulating MKR and AAVE when the DeFi scene is recovering following the sharp contraction from 2022. The industry manages over $56 billion, with Ethereum hosting more liquid DeFi protocols, including Lido DAO when writing in mid-January 2024.

Will Maker and Aave Rally To New 2024 Highs On Recovering DeFi?

Last year, MKR and AAVE were among the top-performing DeFi tokens, with MKR rising by over 200% and AAVE appreciating by more than 150%. Protocol-specific fundamentals, including the launch of Spark in Maker, partly drove this strong performance.

Aave launched the GHO stablecoin and the Lens protocol on the Ethereum sidechain, Polygon. Moreover, expectations of the spot Bitcoin ETF forced aggressive traders to consider top DeFi protocols, lifting altcoins.

As whales accumulate, there is more headroom for these tokens to grow. Presently, AAVE and MKR are lower, based on their respective performance in the daily chart. However, overly, the uptrend remains. To illustrate, MKR is within a bullish breakout formation with a critical support level of around $1,560. Any surge past $2,300 might ignite demand, lifting the token to new 2024 highs.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link