[ad_1]

Within the insurance industry, we understand that in order to remain relevant and retain market share we need to be agile, innovative and adopt new technologies. From a technical point of view, this means that insurers need to be able to adapt their enterprise architecture quickly and sustainably in order to reinvent themselves and grow. However, in an industry rife with legacy architecture, systems modernization is a pressing problem. How can insurers design future systems that both uphold the legacy they have created and integrate into the modern world?

Accenture is working alongside its insurance clients to address this challenge. The result is a new frontier in how technological infrastructure is built.

Insurance architecture design is changing

We need to change how insurance architecture is designed for greater agility and growth. This is not confined to our industry alone. Across all industries, there is a seismic shift from inflexible, monolithic architecture to modular apps that can adapt to business change by assembling, reassembling, and extending. This assists organizations in keeping pace with changing customer demands, supply chain disruptions, economic uncertainty, and the rapid pace of technological advancement.

Insurance is an industry rich with data yet often encumbered by legacy technology. New, adaptable solutions will set leading insurers apart. According to Gartner, by 2023 organizations that have adopted an intelligent composable approach will outpace competition by 80% in the speed of new feature implementation.

The composable enterprise in insurance – what’s new

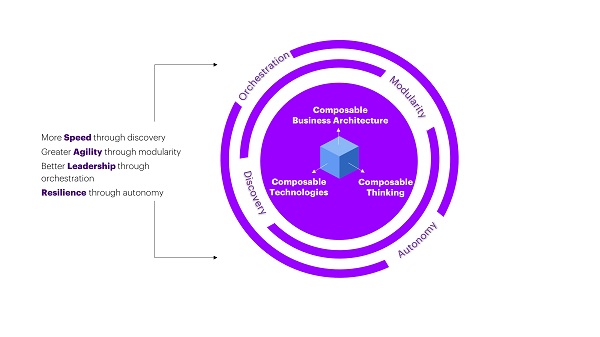

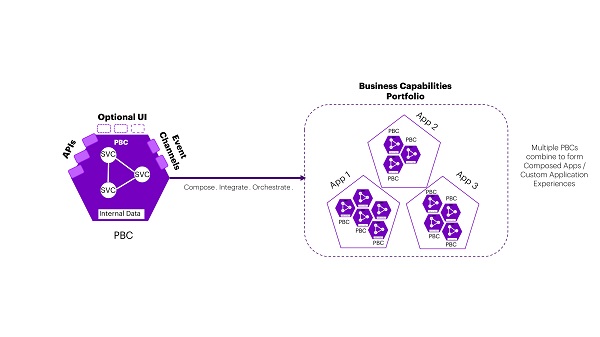

A composable enterprise can be defined as an organization that delivers business outcomes effectively and adapts to the pace of business change. The digital architecture that enables the composable enterprise is built on a strong Application Program Interface (API)-centric mindset, with business functions that are encapsulated in interchangeable components. In composable architecture, APIs help to enhance pliability and ecosystem oversight. This helps the organizations to democratize the business process and become a highly scalable digital business. For insurers, this approach holds numerous possibilities to simplify and scale their digital operations. Packaged business Capabilities (PBCs) – encapsulated software components that represent a well-defined business capability – can be created to be easily recognizable to business users. While the concept of composable architecture has been around for a few years, we are now harnessing the power of PBCs to create truly replicable and scalable infrastructure solutions.

How insurers can benefit

By leveraging the possibilities of a composable enterprise and PBCs, insurers can scale with speed and agility. to create a strong foundation for a composable enterprise:

- Build Modular Business Capabilities: If insurers want to build a scalable composable architecture, they need to have a set of autonomous business capabilities that can be plugged together to execute a business process uniquely that brings a competitive advantage. These modular business capabilities should have the ability to be managed independently and improved while participating in a larger business model.

- Create Modular Technology Capabilities: To support the modular business capabilities, insurers need to build modular technology capabilities that can be easily integrated to enable smarter business models. These need to be autonomous, managed and modular in order to be combined via a standard interface to support the required business need.

In summary, taking a composable approach to technological architecture in insurance has game-changing potential. It allows insurers to future-proof strategy through design, focus on proactive creation and see increased speed in feature implementation. In our next blog post in this series, I will share practical examples of composable architecture in an insurance claims context.

Get the latest insurance industry insights, news, and research delivered straight to your inbox.

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our professional advisors.

Disclaimer: This document refers to marks owned by third parties. All such third-party marks are the property of their respective owners. No sponsorship, endorsement or approval of this content by the owners of such marks is intended, expressed or implied.

[ad_2]

Source link