[ad_1]

Over 650,000 units of staked Ethereum, valued at approximately $1.6 billion, were redeemed last week—the largest amount of redemption since the Shanghai Upgrade was completed last year.

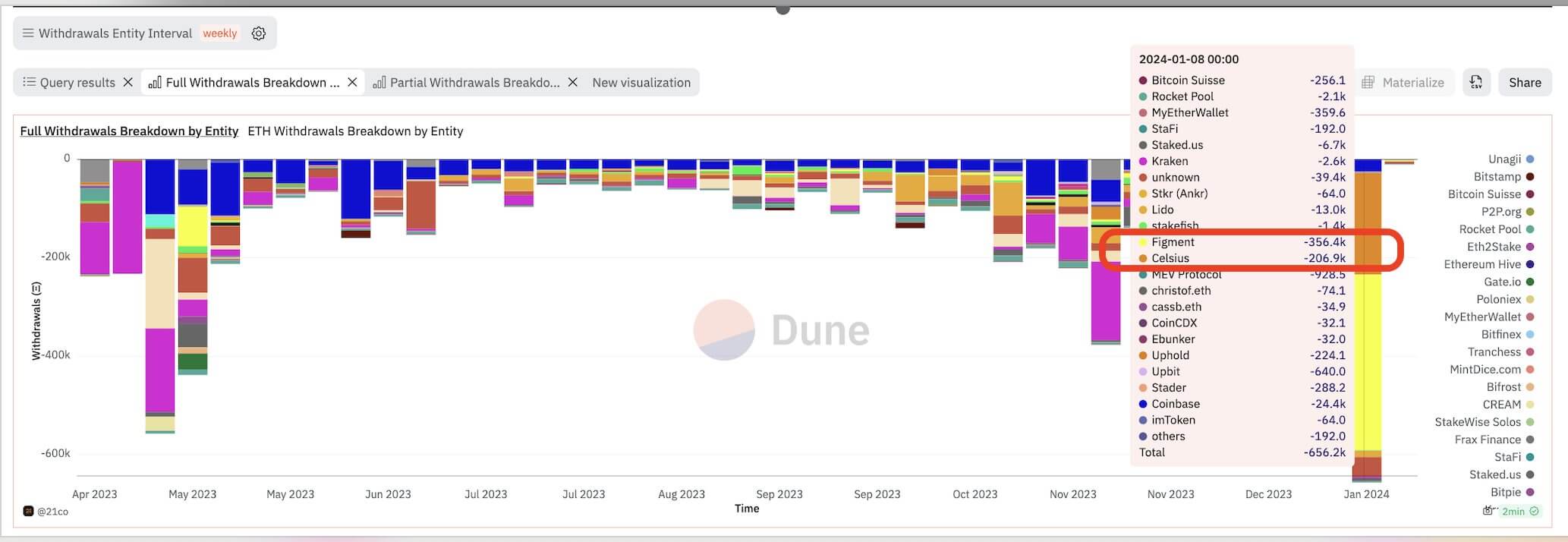

A Dune Analytics dashboard shared by Tom Wan, an analyst at 21 Shares, showed that the bankrupt crypto lender Celsius and staking service provider Figment were the primary contributors to this substantial redemption surge. Together, they orchestrated withdrawals totaling 563,300 staked ETH, constituting an impressive 85% of the total redemptions during the reporting period.

CryptoSlate highlighted these firms’ role in pushing Ethereum’s validator exits to a record high of over 16,000 validators on Jan. 5. At the time, the two firms made up roughly 75% of the total withdrawals in the queue as they planned to remove more than 550,000 staked Ethereum.

Celsius previously revealed plans to unstake 206,300 ETH, worth around $470 million, as part of efforts for its bankruptcy process. The failed lender said the withdrawals would be used to facilitate the distribution of assets to its creditors.

On the other hand, Figment was also making substantial withdrawals of over 350,000 staked ETH on its clients’ behalf.

Following these substantial withdrawals, the total amount of staked Ethereum now sits at 28.9 million, according to Nansen’s Ethereum Shanghai (Shapella) Upgrade dashboard.

ETH’s price unaffected

The staked Ethereum withdrawal activity did not negatively impact ETH’s price performance during the past week, as the digital asset’s value rose by around 12% to a peak of $2700, its highest value since May 2022.

Suggestions that the U.S. Securities and Exchange Commission could approve a spot Ethereum exchange-traded fund (ETF) following similar approvals granted to Bitcoin ETFs have contributed to this upward price movement.

Larry Fink, the CEO of asset management firm BlackRock, further fueled the optimism when he said he saw “value in having an Ethereum ETF” during an interview with CNBC.

Data from Polymarket shows that around 55% of bets on the platform anticipate an Ethereum ETF approval by the end of May.

[ad_2]

Source link