[ad_1]

One of the latest ideas that has come to recently achieve some prominence in parts of the Bitcoin community is the line of thinking that has been described by both myself and others as “Bitcoin dominance maximalism” or just “Bitcoin maximalism” for short – essentially, the idea that an environment of multiple competing cryptocurrencies is undesirable, that it is wrong to launch “yet another coin”, and that it is both righteous and inevitable that the Bitcoin currency comes to take a monopoly position in the cryptocurrency scene. Note that this is distinct from a simple desire to support Bitcoin and make it better; such motivations are unquestionably beneficial and I personally continue to contribute to Bitcoin regularly via my python library pybitcointools. Rather, it is a stance that building something on Bitcoin is the only correct way to do things, and that doing anything else is unethical (see this post for a rather hostile example). Bitcoin maximalists often use “network effects” as an argument, and claim that it is futile to fight against them. However, is this ideology actually such a good thing for the cryptocurrency community? And is its core claim, that network effects are a powerful force strongly favoring the eventual dominance of already established currencies, really correct, and even if it is, does that argument actually lead where its adherents think it leads?

The Technicals

First, an introduction to the technical strategies at hand. In general, there are three approaches to creating a new crypto protocol:

- Build on Bitcoin the blockchain, but not Bitcoin the currency (metacoins, eg. most features of Counterparty)

- Build on Bitcoin the currency, but not Bitcoin the blockchain (sidechains)

- Create a completely standalone platform

Meta-protocols are relatively simple to describe: they are protocols that assign a secondary meaning to certain kinds of specially formatted Bitcoin transactions, and the current state of the meta-protocol can be determined by scanning the blockchain for valid metacoin transactions and sequentially processing the valid ones. The earliest meta-protocol to exist was Mastercoin; Counterparty is a newer one. Meta-protocols make it much quicker to develop a new protocol, and allow protocols to benefit directly from Bitcoin’s blockchain security, although at a high cost: meta-protocols are not compatible with light client protocols, so the only efficient way to use a meta-protocol is via a trusted intermediary.

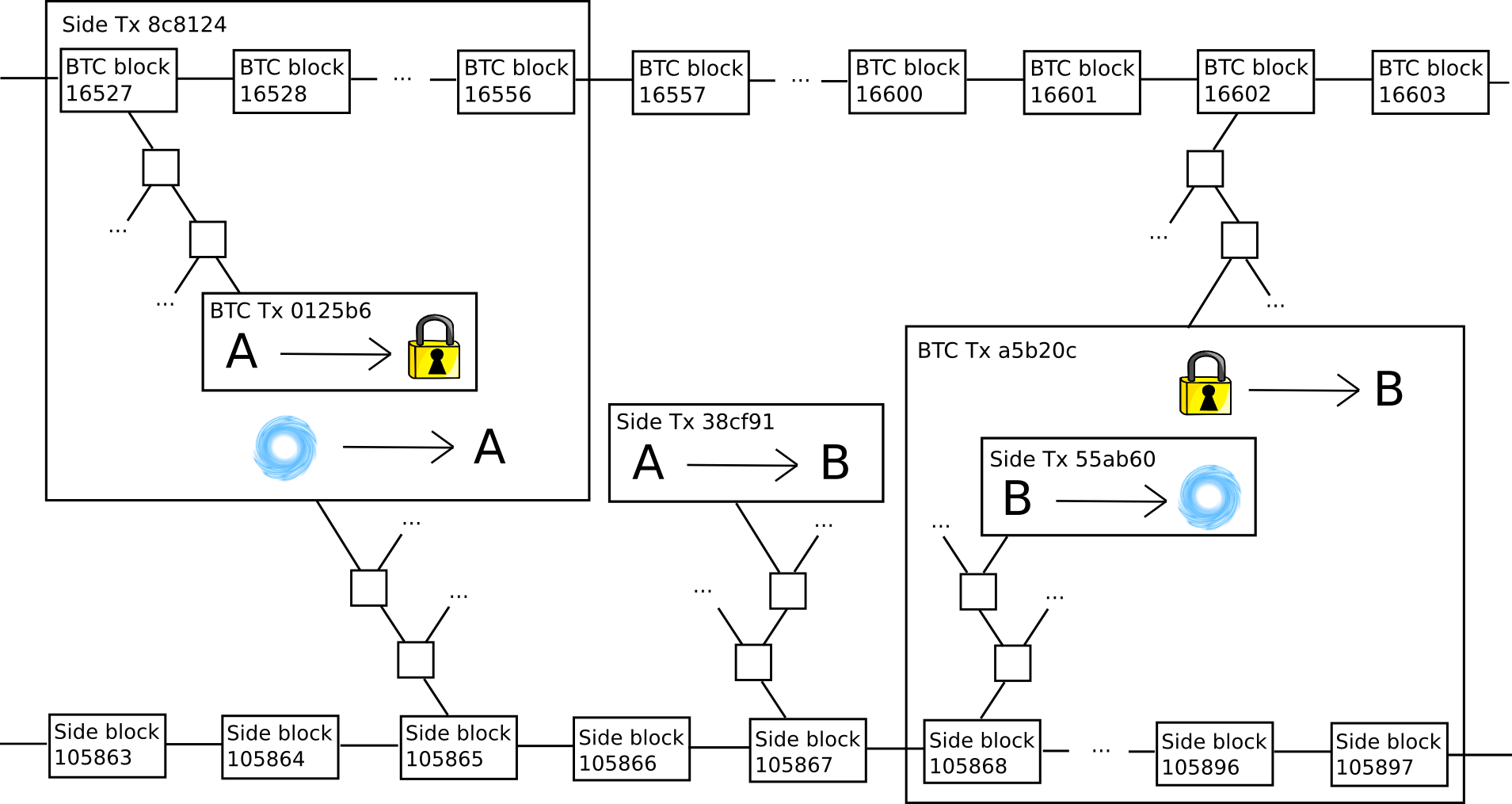

Sidechains are somewhat more complicated. The core underlying idea revolves around a “two-way-pegging” mechanism, where a “parent chain” (usually Bitcoin) and a “sidechain” share a common currency by making a unit of one convertible into a unit of the other. The way it works is as follows. First, in order to get a unit of side-coin, a user must send a unit of parent-coin into a special “lockbox script”, and then submit a cryptographic proof that this transaction took place into the sidechain. Once this transaction confirms, the user has the side-coin, and can send it at will. When any user holding a unit of side-coin wants to convert it back into parent-coin, they simply need to destroy the side-coin, and then submit a proof that this transaction took place to a lockbox script on the main chain. The lockbox script would then verify the proof, and if everything checks out it would unlock the parent-coin for the submitter of the side-coin-destroying transaction to spend.

Unfortunately, it is not practical to use the Bitcoin blockchain and currency at the same time; the basic technical reason is that nearly all interesting metacoins involve moving coins under more complex conditions than what the Bitcoin protocol itself supports, and so a separate “coin” is required (eg. MSC in Mastercoin, XCP in Counterparty). As we will see, each of these approaches has its own benefits, but it also has its own flaws. This point is important; particularly, note that many Bitcoin maximalists’ recent glee at Counterparty forking Ethereum was misplaced, as Counterparty-based Ethereum smart contracts cannot manipulate BTC currency units, and the asset that they are instead likely to promote (and indeed already have promoted) is the XCP.

Network Effects

Now, let us get to the primary argument at play here: network effects. In general, network effects can be defined simply: a network effect is a property of a system that makes the system intrinsically more valuable the more people use it. For example, a language has a strong network effect: Esperanto, even if it is technically superior to English in the abstract, is less useful in practice because the whole point of a language is to communicate with other people and not many other people speak Esperanto. On the other hand, a single road has a negative network effect: the more people use it the more congested it becomes.

In order to properly understand what network effects are at play in the cryptoeconomic context, we need to understand exactly what these network effects are, and exactly what thing each effect is attached to. Thus, to start off, let us list a few of the major ones (see here and here for primary sources):

- Security effect: systems that are more widely adopted derive their consensus from larger consensus groups, making them more difficult to attack.

- Payment system network effect: payment systems that are accepted by more merchants are more attractive to consumers, and payment systems used by more consumers are more attractive to merchants.

- Developer network effect: there are more people interested in writing tools that work with platforms that are widely adopted, and the greater number of these tools will make the platform easier to use.

- Integration network effect: third party platforms will be more willing to integrate with a platform that is widely adopted, and the greater number of these tools will make the platform easier to use.

- Size stability effect: currencies with larger market cap tend to be more stable, and more established cryptocurrencies are seen as more likely (and therefore by self-fulfilling-prophecy actually are more likely) to remain at nonzero value far into the future.

- Unit of account network effect: currencies that are very prominent, and stable, are used as a unit of account for pricing goods and services, and it is cognitively easier to keep track of one’s funds in the same unit that prices are measured in.

- Market depth effect: larger currencies have higher market depth on exchanges, allowing users to convert larger quantities of funds in and out of that currency without taking a hit on the market price.

- Market spread effect: larger currencies have higher liquidity (ie. lower spread) on exchanges, allowing users to convert back and forth more efficiently.

- Intrapersonal single-currency preference effect: users that already use a currency for one purpose prefer to use it for other purposes both due to lower cognitive costs and because they can maintain a lower total liquid balance among all cryptocurrencies without paying interchange fees.

- Interpersonal single-currency preference effect: users prefer to use the same currency that others are using to avoid interchange fees when making ordinary transactions

- Marketing network effect: things that are used by more people are more prominent and thus more likely to be seen by new users. Additionally, users have more knowledge about more prominent systems and thus are less concerned that they might be exploited by unscrupulous parties selling them something harmful that they do not understand.

- Regulatory legitimacy network effect: regulators are less likely to attack something if it is prominent because they will get more people angry by doing so

The first thing that we see is that these network effects are actually rather neatly split up into several categories: blockchain-specific network effects (1), platform-specific network effects (2-4), currency-specific network effects (5-10), and general network effects (11-12), which are to a large extent public goods across the entire cryptocurrency industry. There is a substantial opportunity for confusion here, since Bitcoin is simultaneously a blockchain, a currency and a platform, but it is important to make a sharp distinction between the three. The best way to delineate the difference is as follows:

- A currency is something which is used as a medium of exchange or store of value; for example, dollars, BTC and DOGE.

- A platform is a set of interoperating tools and infrastructure that can be used to perform certain tasks; for currencies, the basic kind of platform is the collection of a payment network and the tools needed to send and receive transactions in that network, but other kinds of platforms may also emerge.

- A blockchain is a consensus-driven distributed database that modifies itself based on the content of valid transactions according to a set of specified rules; for example, the Bitcoin blockchain, the Litecoin blockchain, etc.

To see how currencies and platforms are completely separate, the best example to use is the world of fiat currencies. Credit cards, for example, are a highly multi-currency platform. Someone with a credit card from Canada tied to a bank account using Canadian dollars can spend funds at a merchant in Switzerland accepting Swiss francs, and both sides barely know the difference. Meanwhile, even though both are (or at least can be) based on the US dollar, cash and Paypal are completely different platforms; a merchant accepting only cash will have a hard time with a customer who only has a Paypal account.

As for how platforms and blockchains are separate, the best example is the Bitcoin payment protocol and proof of existence. Although the two use the same blockchain, they are completely different applications, users of one have no idea how to interpret transactions associated with the other, and it is relatively easy to see how they benefit from completely different network effects so that one can easily catch on without the other. Note that protocols like proof of existence and Factom are mostly exempt from this discussion; their purpose is to embed hashes into the most secure available ledger, and while a better ledger has not materialized they should certainly use Bitcoin, particularly because they can use Merkle trees to compress a large number of proofs into a single hash in a single transaction.

Network Effects and Metacoins

Now, in this model, let us examine metacoins and sidechains separately. With metacoins, the situation is simple: metacoins are built on Bitcoin the blockchain, and not Bitcoin the platform or Bitcoin the currency. To see the former, note that users need to download a whole new set of software packages in order to be able to process Bitcoin transactions. There is a slight cognitive network effect from being able to use the same old infrastructure of Bitcoin private/public key pairs and addresses, but this is a network effect for the combination of ECDSA, SHA256+RIPEMD160 and base 58 and more generally the whole concept of cryptocurrency, not the Bitcoin platform; Dogecoin inherits exactly the same gains. To see the latter, note that, as mentioned above, Counterparty has its own internal currency, the XCP. Hence, metacoins benefit from the network effect of Bitcoin’s blockchain security, but do not automatically inherit all of the platform-specific and currency-specific network effects.

Of course, metacoins’ departure from the Bitcoin platform and Bitcoin currency is not absolute. First of all, even though Counterparty is not “on” the Bitcoin platform, it can in a very meaningful sense be said to be “close” to the Bitcoin platform – one can exchange back and forth between BTC and XCP very cheaply and efficiently. Cross-chain centralized or decentralized exchange, while possible, is several times slower and more costly. Second, some features of Counterparty, particularly the token sale functionality, do not rely on moving currency units under any conditions that the Bitcoin protocol does not support, and so one can use that functionality without ever purchasing XCP, using BTC directly. Finally, transaction fees in all metacoins can be paid in BTC, so in the case of purely non-financial applications metacoins actually do fully benefit from Bitcoin’s currency effect, although we should note that in most non-financial cases developers are used to messaging being free, so convincing anyone to use a non-financial blockchain dapp at $0.05 per transaction will likely be an uphill battle.

In some of these applications – particularly, perhaps to Bitcoin maximalists’ chagrin, Counterparty’s crypto 2.0 token sales, the desire to move back and forth quickly to and from Bitcoin, as well as the ability to use it directly, may indeed create a platform network effect that overcomes the loss of secure light client capability and potential for blockchain speed and scalability upgrades, and it is in these cases that metacoins may find their market niche. However, metacoins are most certainly not an all-purpose solution; it is absurd to believe that Bitcoin full nodes will have the computational ability to process every single crypto transaction that anyone will ever want to do, and so eventually movement to either scalable architectures or multichain environments will be necessary.

Network Effects and Sidechains

Sidechains have the opposite properties of metacoins. They are built on Bitcoin the currency, and thus benefit from Bitcoin’s currency network effects, but they are otherwise exactly identical to fully independent chains and have the same properties. This has several pros and cons. On the positive side, it means that, although “sidechains” by themselves are not a scalability solution as they do not solve the security problem, future advancements in multichain, sharding or other scalability strategies are all open to them to adopt.

On the negative side, however, they do not benefit from Bitcoin’s platform network effects. One must download special software in order to be able to interact with a sidechain, and one must explicitly move one’s bitcoins onto a sidechain in order to be able to use it – a process wich is equally as difficult as converting them into a new currency in a new network via a decentralized exchange. In fact, Blockstream employees have themselves admitted that the process for converting side-coins back into bitcoins is relatively inefficient, to the point that most people seeking to move their bitcoins there and back will in fact use exactly the same centralized or decentralized exchange processes as would be used to migrate to a different currency on an independent blockchain.

Additionally, note that there is one security approach that independent networks can use which is not open to sidechains: proof of stake. The reasons for this are twofold. First one of the key arguments in favor of proof of stake is that even a successful attack against proof of stake will be costly for the attacker, as the attacker will need to keep his currency units deposited and watch their value drop drastically as the market realizes that the coin is compromised. This incentive effect does not exist if the only currency inside of a network is pegged to an external asset whose value is not so closely tied to that network’s success.

Second, proof of stake gains much of its security because the process of buying up 50% of a coin in order to mount a takeover attack will itself increase the coin’s price drastically, making the attack even more expensive for the attacker. In a proof of stake sidechain, however, one can easily move a very large quantity of coins into a chain from the parent chain, an mount the attack without moving the asset price at all. Note that both of these arguments continue to apply even if Bitcoin itself upgrades to proof of stake for its security. Hence, if you believe that proof of stake is the future, then both metacoins and sidechains (or at least pure sidechains) become highly suspect, and thus for that purely technical reason Bitcoin maximalism (or, for that matter, ether maximalism, or any other kind of currency maximalism) becomes dead in the water.

Currency Network Effects, Revisited

Altogether, the conclusion from the above two points is twofold. First, there is no universal and scalable approach that allows users to benefit from Bitcoin’s platform network effects. Any software solution that makes it easy for Bitcoin users to move their funds to sidechains can be easily converted into a solution that makes it just as easy for Bitcoin users to convert their funds into an independent currency on an independent chain. On the other hand, however, currency network effects are another story, and may indeed prove to be a genuine advantage for Bitcoin-based sidechains over fully independent networks. So, what exactly are these effects and how powerful is each one in this context? Let us go through them again:

- Size-stability network effect (larger currencies are more stable) – this network effect is legitimate, and Bitcoin has been shown to be less volatile than smaller coins.

- Unit of account network effect (very large currencies become units of account, leading to more purchasing power stability via price stickiness as well as higher salience) – unfortunately, Bitcoin will likely never be stable enough to trigger this effect; the best empirical evidence we can see for this is likely the valuation history of gold.

- Market depth effect (larger currencies support larger transactions without slippage and have a lower bid/ask spread) – these effect are legitimate up to a point, but then beyond that point (perhaps a market cap of $10-$100M), the market depth is imply good enough and the spread is low enough for nearly all types of transactions, and the benefit from further gains is small.

- Single-currency preference effect (people prefer to deal with fewer currencies, and prefer to use the same currencies that others are using) – the intrapersonal and interpersonal parts to this effect are legitimate, but we note that (i) the intrapersonal effect only applies within individual people, not between people, so it does not prevent an ecosystem with multiple preferred global currencies from existing, and (ii) the interpersonal effect is small as interchange fees especially in crypto tend to be very low, less than 0.30%, and will likely go down to essentially zero with decentralized exchange.

Hence, the single-currency preference effect is likely the largest concern, followed by the size stability effects, whereas the market depth effects are likely relatively tiny once a cryptocurrency gets to a substantial size. However, it is important to note that the above points have several major caveats. First, if (1) and (2) dominate, then we know of explicit strategies for making a new coin that is even more stable than Bitcoin even at a smaller size; thus, they are certainly not points in Bitcoin’s favor.

Second, those same strategies (particularly the exogenous ones) can actually be used to create a stable coin that is pegged to a currency that has vastly larger network effects than even Bitcoin itself; namely, the US dollar. The US dollar is thousands of times larger than Bitcoin, people are already used to thinking in terms of it, and most importantly of all it actually maintains its purchasing power at a reasonable rate in the short to medium term without massive volatility. Employees of Blockstream, the company behind sidechains, have often promoted sidechains under the slogan “innovation without speculation“; however, the slogan ignores that Bitcoin itself is quite speculative and as we see from the experience of gold always will be, so seeking to install Bitcoin as the only cryptoasset essentially forces all users of cryptoeconomic protocols to participate in speculation. Want true innovation without speculation? Then perhaps we should all engage in a little US dollar stablecoin maximalism instead.

Finally, in the case of transaction fees specifically, the intrapersonal single-currency preference effect arguably disappears completely. The reason is that the quantities involved are so small ($0.01-$0.05 per transaction) that a dapp can simply siphon off $1 from a user’s Bitcoin wallet at a time as needed, not even telling the user that other currencies exist, thereby lowering the cognitive cost of managing even thousands of currencies to zero. The fact that this token exchange is completely non-urgent also means that the client can even serve as a market maket while moving coins from one chain to the other, perhaps even earning a profit on the currency interchange bid/ask spread. Furthermore, because the user does not see gains and losses, and the user’s average balance is so low that the central limit theorem guarantees with overwhelming probability that the spikes and drops will mostly cancel each other out, stability is also fairly irrelevant. Hence, we can make the point that alternative tokens which are meant to serve primarily as “cryptofuels” do not suffer from currency-specific network effect deficiencies at all. Let a thousand cryptofuels bloom.

Incentive and Psychological Arguments

There is another class of argument, one which may perhaps be called a network effect but not completely, for why a service that uses Bitcoin as a currency will perform better: the incentivized marketing of the Bitcoin community. The argument goes as follows. Services and platforms based on Bitcoin the currency (and to a slight extent services based on Bitcoin the platform) increase the value of Bitcoin. Hence, Bitcoin holders would personally benefit from the value of their BTC going up if the service gets adopted, and are thus motivated to support it.

This effect occurs on two levels: the individual and the corporate. The corporate effect is a simple matter of incentives; large businesses will actually support or even create Bitcoin-based dapps to increase Bitcoin’s value, simply because they are so large that even the portion of the benefit that personally accrues to themselves is enough to offset the costs; this is the “speculative philanthropy” strategy described by Daniel Krawisz.

The individual effect is not so much directly incentive-based; each individual’s ability to affect Bitcoin’s value is tiny. Rather, it’s more a clever exploitation of psychological biases. It’s well-known that people tend to change their moral values to align with their personal interests, so the channel here is more complex: people who hold BTC start to see it as being in the common interest for Bitcoin to succeed, and so they will genuinely and excitedly support such applications. As it turns out, even a small amount of incentive suffices to shift over people’s moral values to such a large extent, creating a psychological mechanism that manages to overcome not just the coordination problem but also, to a weak extent, the public goods problem.

There are several major counterarguments to this claim. First, it is not at all clear that the total effect of the incentive and psychological mechanisms actually increases as the currency gets larger. Although a larger size leads to more people affected by the incentive, a smaller size creates a more concentrated incentive, as people actually have the opportunity to make a substantial difference to the success of the project. The tribal psychology behind incentive-driven moral adjustment may well be stronger for small “tribes” where individuals also have strong social connections to each other than larger tribes where such connections are more diffuse; this is somewhat similar to the Gemeinschaft vs Gesellschaft distinction in sociology. Perhaps a new protocol needs to have a concentrated set of highly incentivized stakeholders in order to seed a community, and Bitcoin maximalists are wrong to try to knock this ladder down after Bitcoin has so beautifully and successfully climbed up it. In any case, all of the research around optimum currency areas will have to be heavily redone in the context of the newer volatile cryptocurrencies, and the results may well go down either way.

Second, the ability for a network to issue units of a new coin has been proven to be a highly effective and successful mechanism for solving the public goods problem of funding protocol development, and any platform that does not somehow take advantage of the seignorage revenue from creating a new coin is at a substantial disadvantage. So far, the only major crypto 2.0 protocol-building company that has successfully funded itself without some kind of “pre-mine” or “pre-sale” is Blockstream (the company behind sidechains), which recently received $21 million of venture capital funding from Silicon Valley investors. Given Blockstream’s self-inflicted inability to monetize via tokens, we are left with three viable explanations for how investors justified the funding:

- The funding was essentially an act of speculative philathropy on the part of Silicon Valley venture capitalists looking to increase the value of their BTC and their other BTC-related investments.

- Blockstream intends to earn revenue by taking a cut of the fees from their blockchains (non-viable because the public will almost certainly reject such a clear and blatant centralized siphoning of resources even more virulently then they would reject a new currency)

- Blockstream intends to “sell services”, ie. follow the RedHat model (viable for them but few others; note that the total room in the market for RedHat-style companies is quite small)

Both (1) and (3) are highly problematic; (3) because it means that few other companies will be able to follow its trail and because it gives them the incentive to cripple their protocols so they can provide centralized overlays, and (1) because it means that crypto 2.0 companies must all follow the model of sucking up to the particular concentrated wealthy elite in Silicon Valley (or maybe an alternative concentrated wealthy elite in China), hardly a healthy dynamic for a decentralized ecosystem that prides itself on its high degree of political independence and its disruptive nature.

Ironically enough, the only “independent” sidechain project that has so far announced itself, Truthcoin, has actually managed to get the best of both worlds: the project got on the good side of the Bitcoin maximalist bandwagon by announcing that it will be a sidechain, but in fact the development team intends to introduce into the platform two “coins” – one of which will be a BTC sidechain token and the other an independent currency that is meant to be, that’s right, crowd-sold.

A New Strategy

Thus, we see that while currency network effects are sometimes moderately strong, and they will indeed exert a preference pressure in favor of Bitcoin over other existing cryptocurrencies, the creation of an ecosystem that uses Bitcoin exclusively is a highly suspect endeavor, and one that will lead to a total reduction and increased centralization of funding (as only the ultra-rich have sufficient concentrated incentive to be speculative philanthropists), closed doors in security (no more proof of stake), and is not even necessarily guaranteed to end with Bitcoin willing. So is there an alternative strategy that we can take? Are there ways to get the best of both worlds, simultaneously currency network effects and securing the benefits of new protocols launching their own coins?

As it turns out, there is: the dual-currency model. The dual-currency model, arguably pioneered by Robert Sams, although in various incarnations independently discovered by Bitshares, Truthcoin and myself, is at the core simple: every network will contain two (or even more) currencies, splitting up the role of medium of transaction and vehicle of speculation and stake (the latter two roles are best merged, because as mentioned above proof of stake works best when participants suffer the most from a fork). The transactional currency will be either a Bitcoin sidechain, as in Truthcoin’s model, or an endogenous stablecoin, or an exogenous stablecoin that benefits from the almighty currency network effect of the US dollar (or Euro or CNY or SDR or whatever else). Hayekian currency competition will determine which kind of Bitcoin, altcoin or stablecoin users prefer; perhaps sidechain technology can even be used to make one particular stablecoin transferable across many networks.

The vol-coin will be the unit of measurement of consensus, and vol-coins will sometimes be absorbed to issue new stablecoins when stablecoins are consumed to pay transaction fees; hence, as explainted in the argument in the linked article on stablecoins, vol-coins can be valued as a percentage of future transaction fees. Vol-coins can be crowd-sold, maintaining the benefits of a crowd sale as a funding mechanism. If we decide that explicit pre-mines or pre-sales are “unfair”, or that they have bad incentives because the developers’ gain is frontloaded, then we can instead use voting (as in DPOS) or prediction markets instead to distribute coins to developers in a decentralized way over time.

Another point to keep in mind is, what happens to the vol-coins themselves? Technological innovation is rapid, and if each network gets unseated within a few years, then the vol-coins may well never see substantial market cap. One answer is to solve the problem by using a clever combination of Satoshian thinking and good old-fashioned recursive punishment systems from the offline world: establish a social norm that every new coin should pre-allocate 50-75% of its units to some reasonable subset of the coins that came before it that directly inspired its creation, and enforce the norm blockchain-style – if your coin does not honor its ancestors, then its descendants will refuse to honor it, instead sharing the extra revenues between the originally cheated ancestors and themselves, and no one will fault them for that. This would allow vol-coins to maintain continuity over the generations. Bitcoin itself can be included among the list of ancestors for any new coin. Perhaps an industry-wide agreement of this sort is what is needed to promote the kind of cooperative and friendly evolutionary competition that is required for a multichain cryptoeconomy to be truly successful.

Would we have used a vol-coin/stable-coin model for Ethereum had such strategies been well-known six months ago? Quite possibly yes; unfortunately it’s too late to make the decision now at the protocol level, particularly since the ether genesis block distribution and supply model is essentially finalized. Fortunately, however, Ethereum allows users to create their own currencies inside of contracts, so it is entirely possible that such a system can simply be grafted on, albeit slightly unnaturally, over time. Even without such a change, ether itself will retain a strong and steady value as a cryptofuel, and as a store of value for Ethereum-based security deposits, simply because of the combination of the Ethereum blockchain’s network effect (which actually is a platform network effect, as all contracts on the Ethereum blockchain have a common interface and can trivially talk to each other) and the weak-currency-network-effect argument described for cryptofuels above preserves for it a stable position. For 2.0 multichain interaction, however, and for future platforms like Truthcoin, the decision of which new coin model to take is all too relevant.

[ad_2]

Source link