[ad_1]

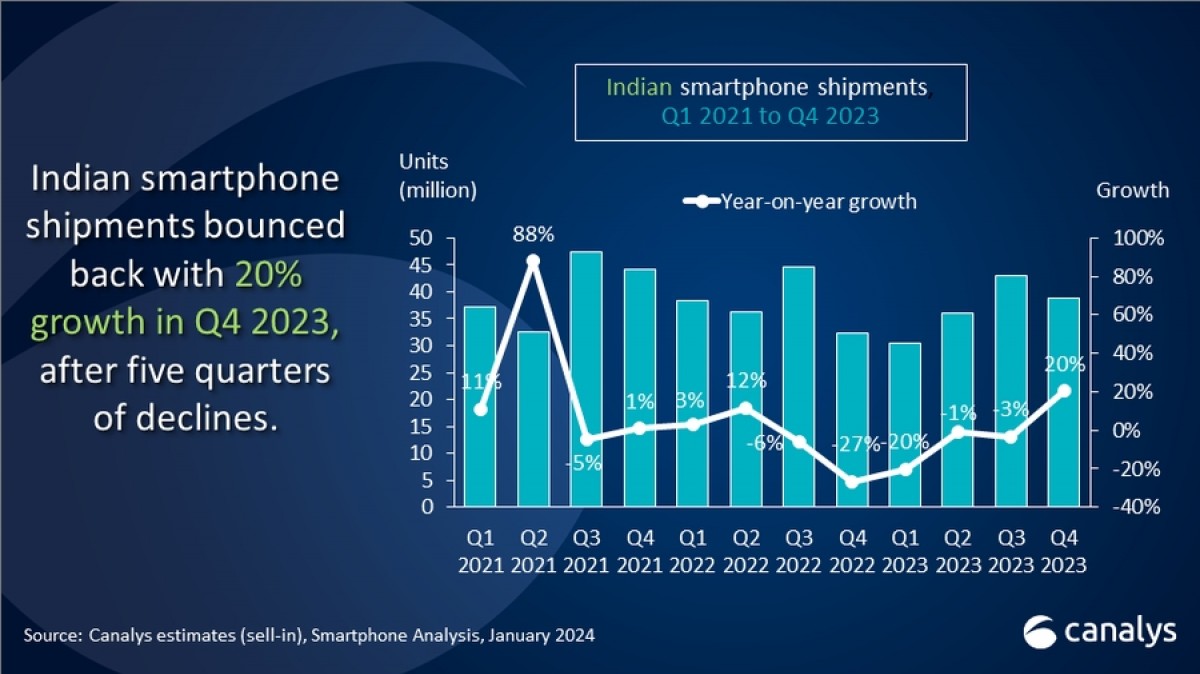

Canalys revealed the smartphone market in India had a year-on-year growth for the first time in five quarters during Q4 2023. Vendors saw a 20% increase in shipments between October and December, helping push sales for the full year to a slight 2% decline compared to 2022.

The total shipments in 2023 were 148.6 million units, 38.9 million of them during Q4.

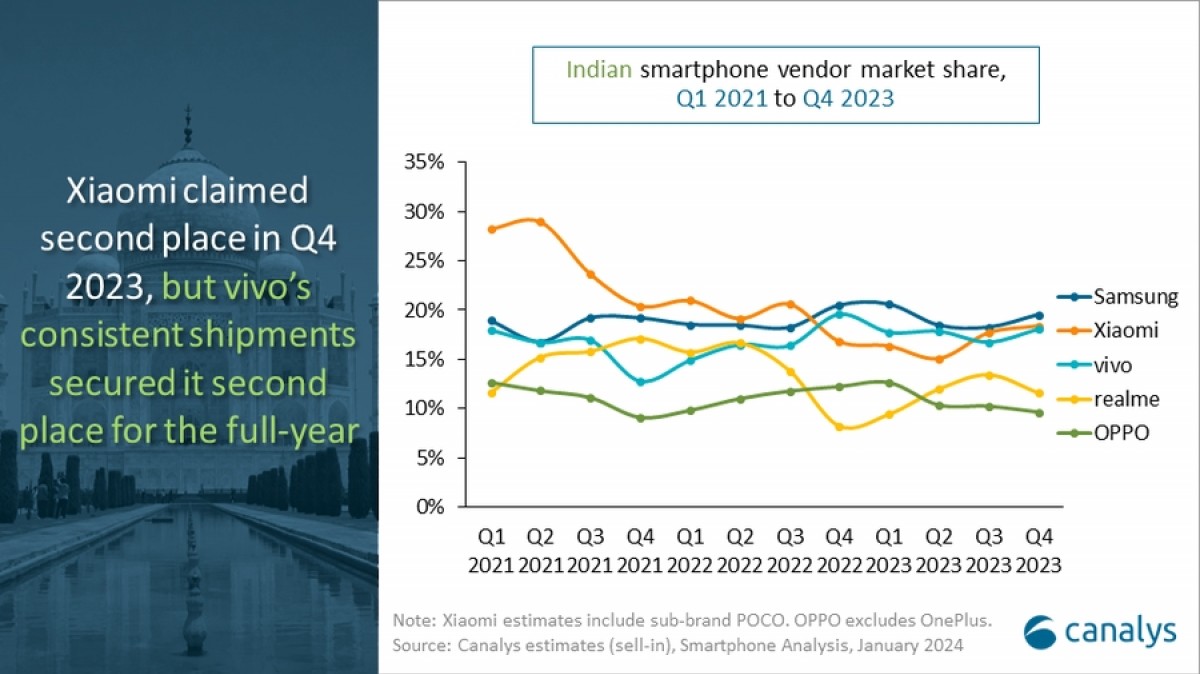

Samsung kept the top position, but competition remained tight, with Xiaomi and vivo closely following in second and third, just 2 percentage points behind.

According to the analysts stronger offline presence helped the Indian market grow in Q4. Xiaomi and Realme shipped half of their devices to brick-and-mortar stores, and this helped them increase their sales tremendously – Xiaomi sales went up 31% in Q4, compared with the same period last year, while Realme saw an even bigger 69% YoY increase.

| Q4 2023 shipments (million) |

Q4 2023 market share |

Q4 2022 shipments (million) |

Q4 2022 market share |

Annual growth | |

| Samsung | 7.6 | 20% | 6.7 | 21% | 14% |

| Xiaomi | 7.2 | 18% | 5.5 | 17% | 31% |

| vivo | 7.0 | 18% | 6.4 | 20% | 10% |

| Realme | 4.5 | 12% | 2.7 | 8% | 69% |

| Oppo | 3.7 | 10% | 4.0 | 12% | -5% |

| Others | 8.9 | 23% | 7.3 | 22% | 23% |

| Total | 38.9 | 100% | 32.4 | 100% | 20% |

According to Sanyam Chaurasia, Senior Analyst at Canalys, the premium segment saw robust growth thanks to attractive financing options and rising disposable income. Apple pushed its iPhone 15 series around Diwali in November and discounted older models such as the iPhone 14 and iPhone 13, allowing the US company to capture a 7% market share.

Similarly, Samsung set aggressive retail targets for its Galaxy S23 devices. There was also the relatively affordable S23 FE that drove shipments, thanks to “compelling banking deals”, added Chaurasia.

| 2023 shipments (million) |

2023 market share |

2022 shipments (million) |

2022 market share |

Annual growth | |

| Samsung | 28.4 | 19% | 28.6 | 19% | -1% |

| vivo | 26.1 | 18% | 25.4 | 17% | 3% |

| Xiaomi | 25.1 | 17% | 29.6 | 20% | -15% |

| Realme | 17.4 | 12% | 20.9 | 14% | -16% |

| Oppo | 15.7 | 11% | 17.0 | 11% | -7% |

| Others | 35.8 | 24% | 30.2 | 20% | 18% |

| Total | 148.6 | 100% | 151.6 | 100% | -2% |

India is having a general election this year, and vendors expect improved indicators for the consumer market, manageable inflation and steady interest rate, as well as a stable government. This would bring a “mid-single-digit” growth for the first half of 2024, driven also by affordable 5G devices and the pandemic period replacement cycle.

[ad_2]

Source link