[ad_1]

Data shows the cryptocurrency futures market has seen liquidations amounting to $700 million in the past day as Bitcoin has gone through its volatility.

Bitcoin Has Seen Intense Price Action In Past 24 Hours

The past day has been a bit of a rollercoaster for Bitcoin, with the asset registering sharp price action in both directions but ultimately going up as the bulls win out.

The chart below shows what the price action for the cryptocurrency has looked like recently.

The price of the asset seems to have enjoyed sharp bullish momentum recently | Source: BTCUSD on TradingView

From the graph, it’s visible that Bitcoin initially witnessed some sharp bullish momentum, in which the coin not only broke above the $60,000 level, but went up to touch the $64,000 mark.

This high, which is the peak for the year so far, only lasted briefly, however, as BTC crashed down spectacularly to under the $59,000 mark. The asset has since recovered to higher levels, now floating around $62,700.

The rest of the cryptocurrency sector has also gone through its volatility, with prices fluctuating across the coins. As is usually the case with such sharp price action, the futures market has suffered many liquidations.

Crypto Futures Market Has Gone Through A Squeeze In The Past Day

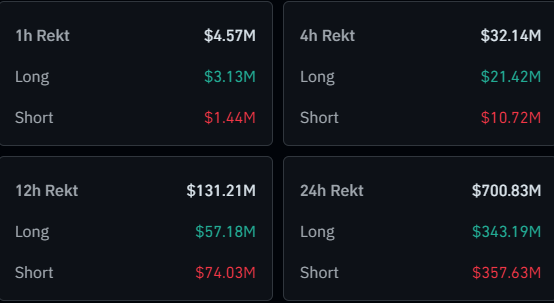

According to data from CoinGlass, the cryptocurrency futures market has witnessed the liquidation of contracts worth more than $700 million in the last 24 hours.

The table below displays the relevant information about the liquidations.

A massive amount of liquidations appear to have occurred in the past day | Source: CoinGlass

It would appear that only $131 million of the liquidations came within twelve hours, suggesting that most of the flush was situated inside the preceding half-day period. This makes sense, as Bitcoin was most volatile inside this window.

It also seems that the long-to-short ratio in this liquidation event has been quite balanced, even though the price has increased in the past day. This would suggest that some aggressive longing occurred as Bitcoin approached $64,000, and the subsequent pullback wiped these top buyers.

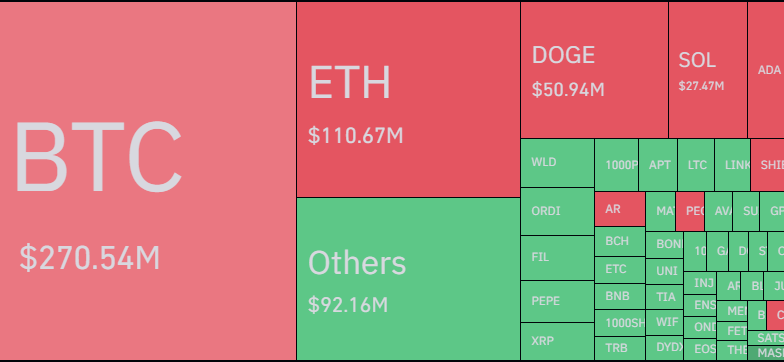

The table below shows how the distribution has looked for the various symbols.

Looks like BTC has topped the charts once more | Source: CoinGlass

As is generally the case, Bitcoin futures contracts have again been responsible for the largest portion of the total market liquidations, contributing around $270 million.

What’s different this time, however, is that this share, although the largest, isn’t even half the total liquidations. This could come down to the fact that speculators may now be playing around with altcoin positions after gaining confidence from the BTC price surge.

Dogecoin, the best performer among the top coins with its 34% jump, has occupied the largest share among the alts, with almost $51 million in liquidations.

Featured image from André François McKenzie on Unsplash.com, CoinGlass.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

[ad_2]

Source link