[ad_1]

Bitcoin’s mempool is a holding area for transactions broadcast to the network but not yet included in a block. Analyzing the mempool provides insight into network congestion, transaction demand, and fee trends, offering a unique vantage point on the state of the Bitcoin ecosystem.

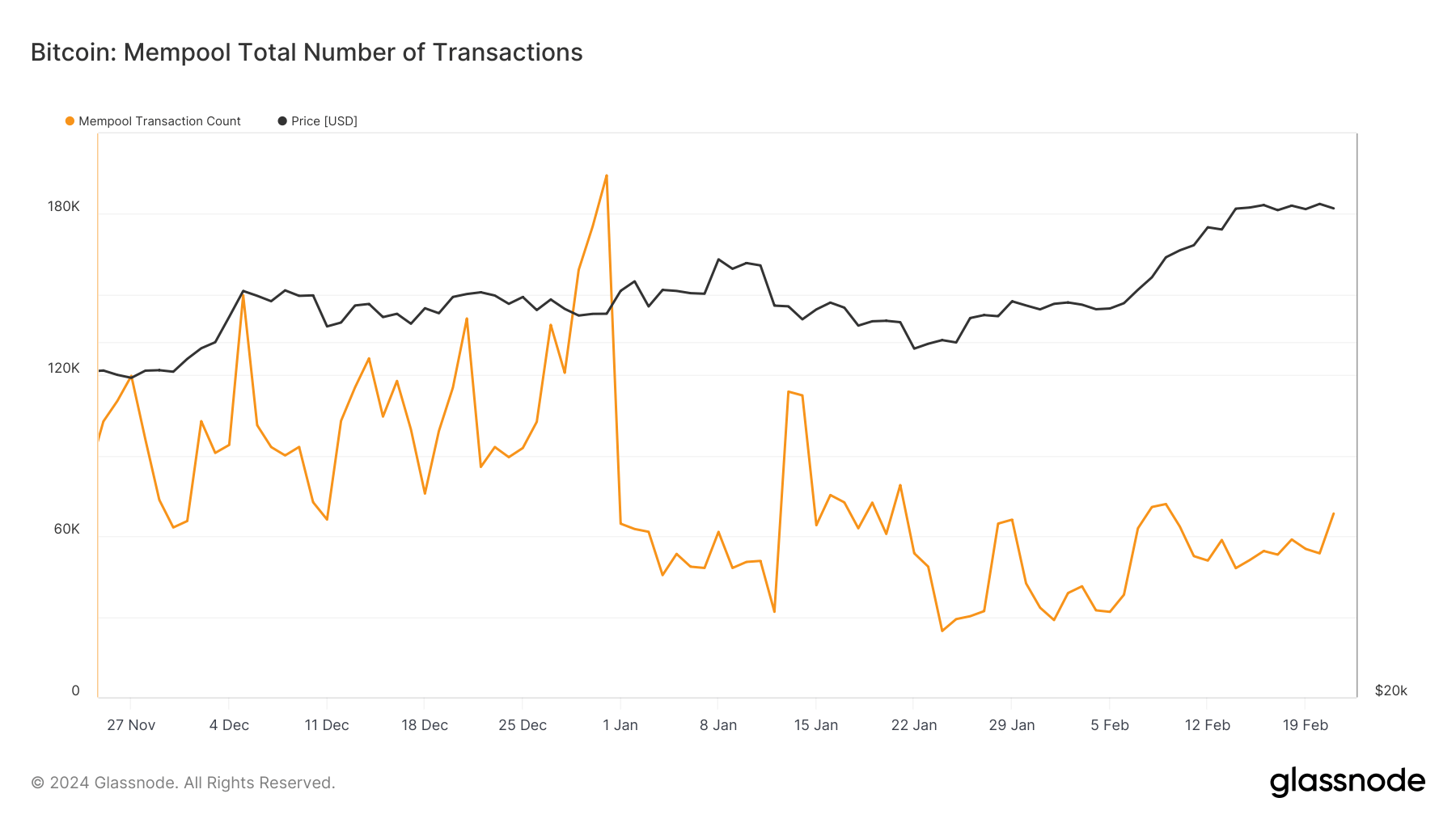

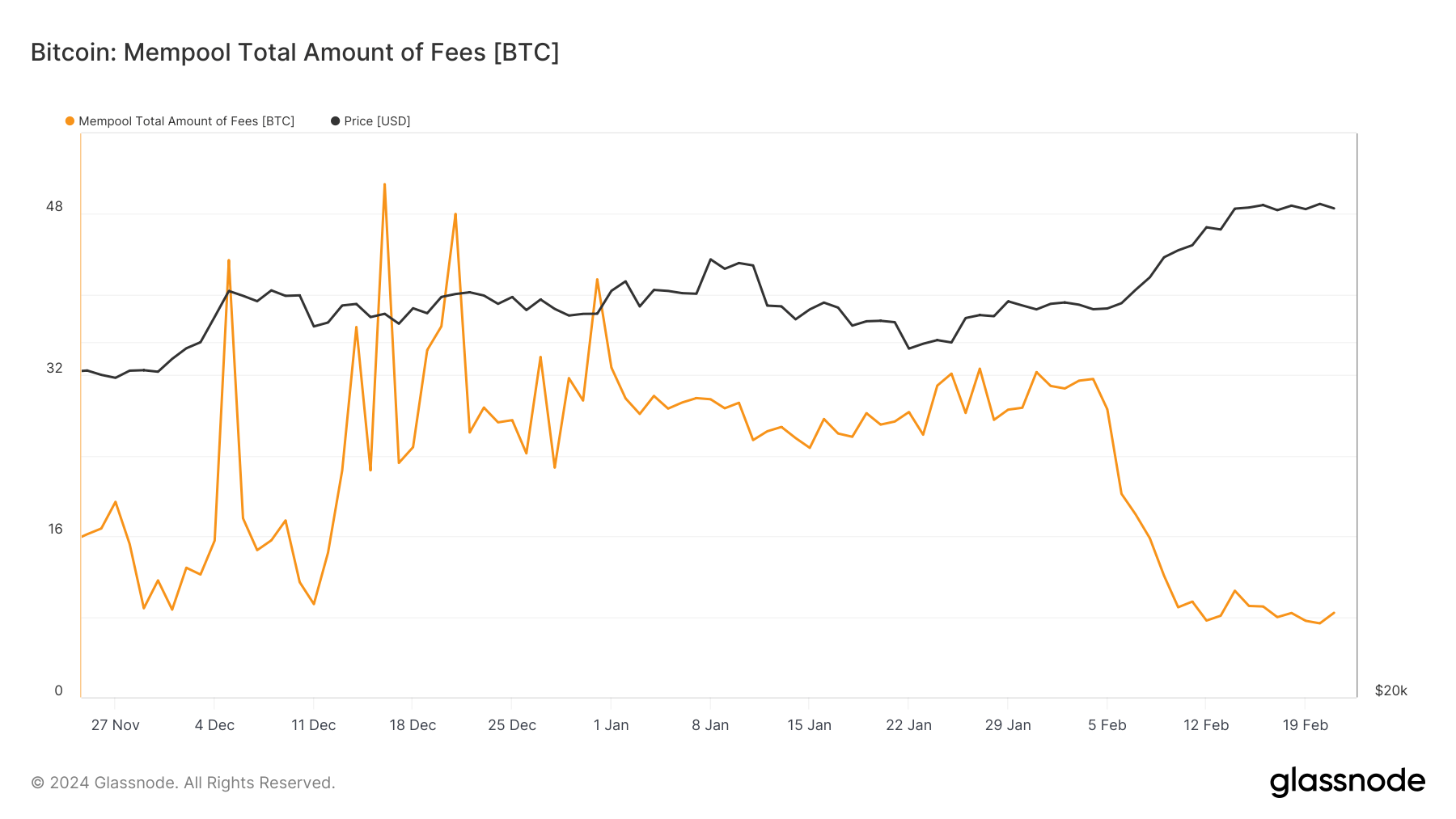

During the final months of 2023 and the early weeks of 2024, the Bitcoin network experienced significant congestion, as evidenced by the swelling size of the mempool. In mid-December, the mempool contained 117,813 transactions waiting to be processed, and transaction fees totaling 50.9 BTC.

This congestion signaled a high demand for block space and highlighted the network’s challenges in accommodating surging transaction volumes. By the end of December, the situation intensified, with the mempool size escalating to 194,374 transactions, indicating a peak in network activity and user engagement.

This congestion had little impact on Bitcoin’s price, which traded at around $42,000 for the better part of December. The persistence of high transaction counts and fees into early January, with the mempool harboring 64,664 transactions and 32.7 BTC in fees on the first day of the year, underscored the network’s strain under the weight of unprocessed transactions.

The total size of transactions awaiting confirmation in the mempool further ballooned to 106.369 million bytes, peaking at 139.457 million by late January, reflecting a backlog of transactions and an increase in the complexity or size of the transactions.

The turning point for the prolonged period of congestion came in February. By Feb. 21, the mempool cleared significantly, with the total transaction fees dropping to 8.3 BTC and the number of waiting transactions reduced to 68,433. The total size of transactions in the mempool also decreased to 90.439 million bytes, indicating a significant alleviation of network congestion.

This period of reduced congestion followed Bitcoin’s bullish rally, which saw it climb over $52,000 and then find stability at the $51,800 level.

The clearing of the mempool congestion in February, despite Bitcoin’s rising price, indicates an improvement in the network’s capacity to process transactions, possibly through miners prioritizing transactions with higher fees or the adoption of efficiency-enhancing measures by users, such as transaction batching or the utilization of off-chain solutions.

Second, the reduction in congestion and fees likely contributed to a positive shift in investor sentiment, viewing the enhanced network performance as a bullish indicator of Bitcoin’s usability and scalability.

[ad_2]

Source link