[ad_1]

Quick Take

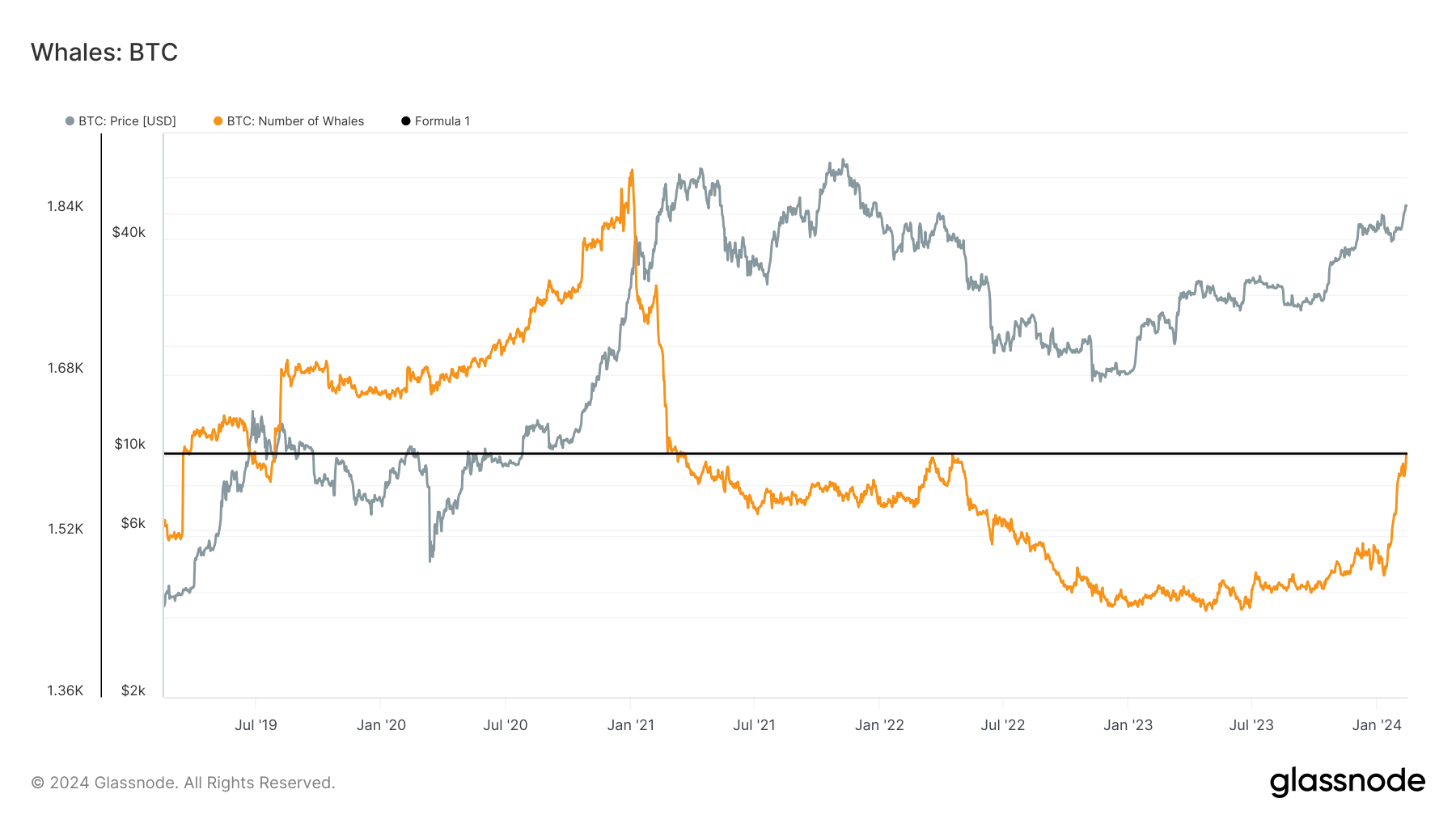

The Bitcoin landscape has witnessed a significant uptick of Bitcoin whales—entities holding 1,000 BTC or more. Their numbers have surged in recent weeks, coinciding with Bitcoin’s rise from $38,000 to $51,000.

Currently, there are 1,602 Bitcoin whales, a considerable uptick from 1,482 in January. This surge not only eclipses the March and April 2022 peak of 1,601 whales, but also marks a three-year high unseen since March 2021.

The last bull run in 2021, which saw Bitcoin skyrocket from $10,000 to $60,000, conversely triggered a notable decline in whale numbers from 1,884 to 1,601, implying a profit-taking strategy.

The current accumulation trend is influenced by large-scale holders, such as Bitcoin ETFs, including Grayscale, that spread their holdings across multiple wallets. Entities like these, with assets under management exceeding $51 million, now meet the whale criteria according to Glassnode metrics.

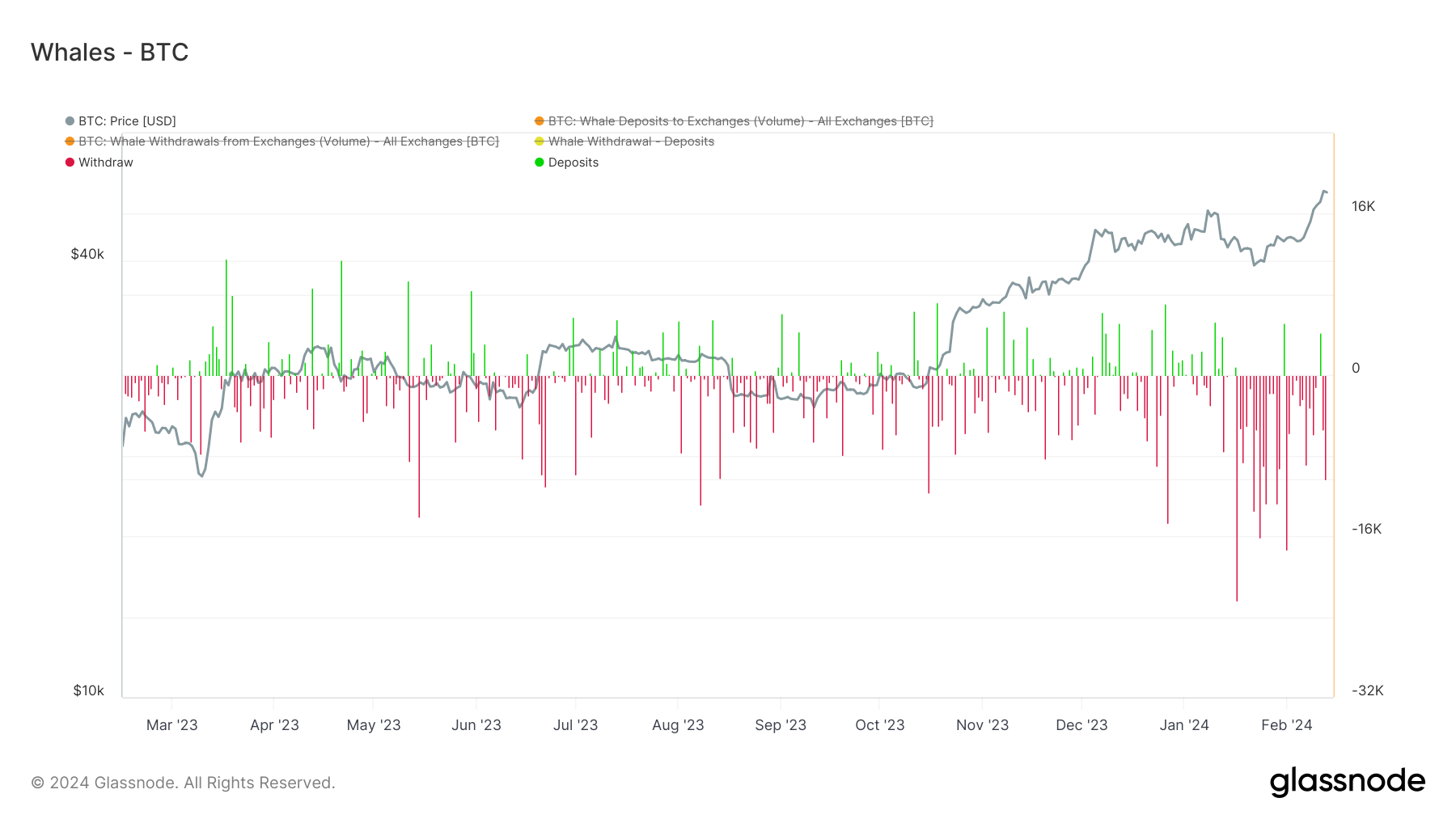

Since Jan. 15, whale withdrawals have surpassed deposits, barring two days, underscoring the extent to which whales have accumulated Bitcoin.

The post Bitcoin whales on the rise as numbers hit three-year high as ETFs join cohort appeared first on CryptoSlate.

[ad_2]

Source link