[ad_1]

The approval of the first spot Bitcoin ETFs by the U.S. Securities and Exchange Commission (SEC) on Jan. 10 was a significant milestone in the crypto market. However, the milestone led to even more significant volatility in Bitcoin’s price and on-chain activity.

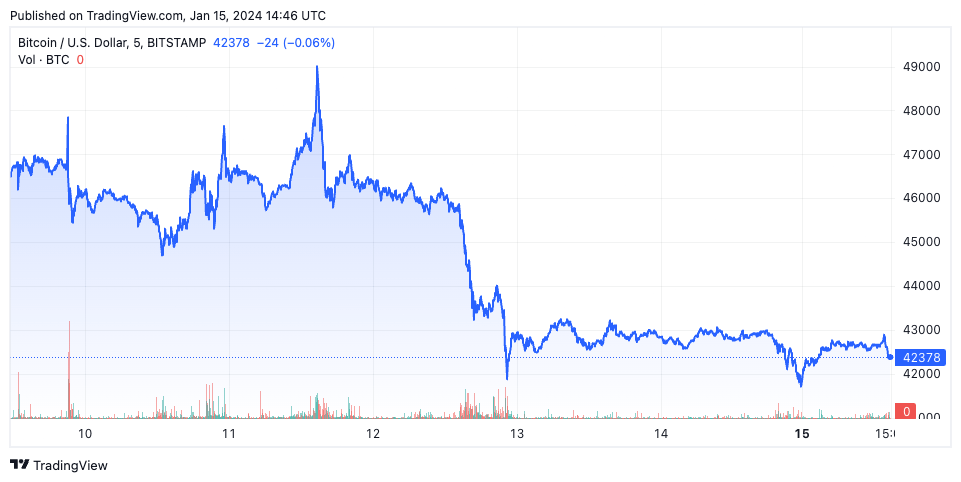

Initially, Bitcoin’s price showed a positive reaction to the news of the ETF approval, climbing to $46,608 on Jan. 10. By Jan. 11, the price declined to $46,393, and a more pronounced drop occurred on Jan. 12, when the price fell to $42,897. This downward trend continued over the following days, culminating in a price of $41,769 on Jan. 14.

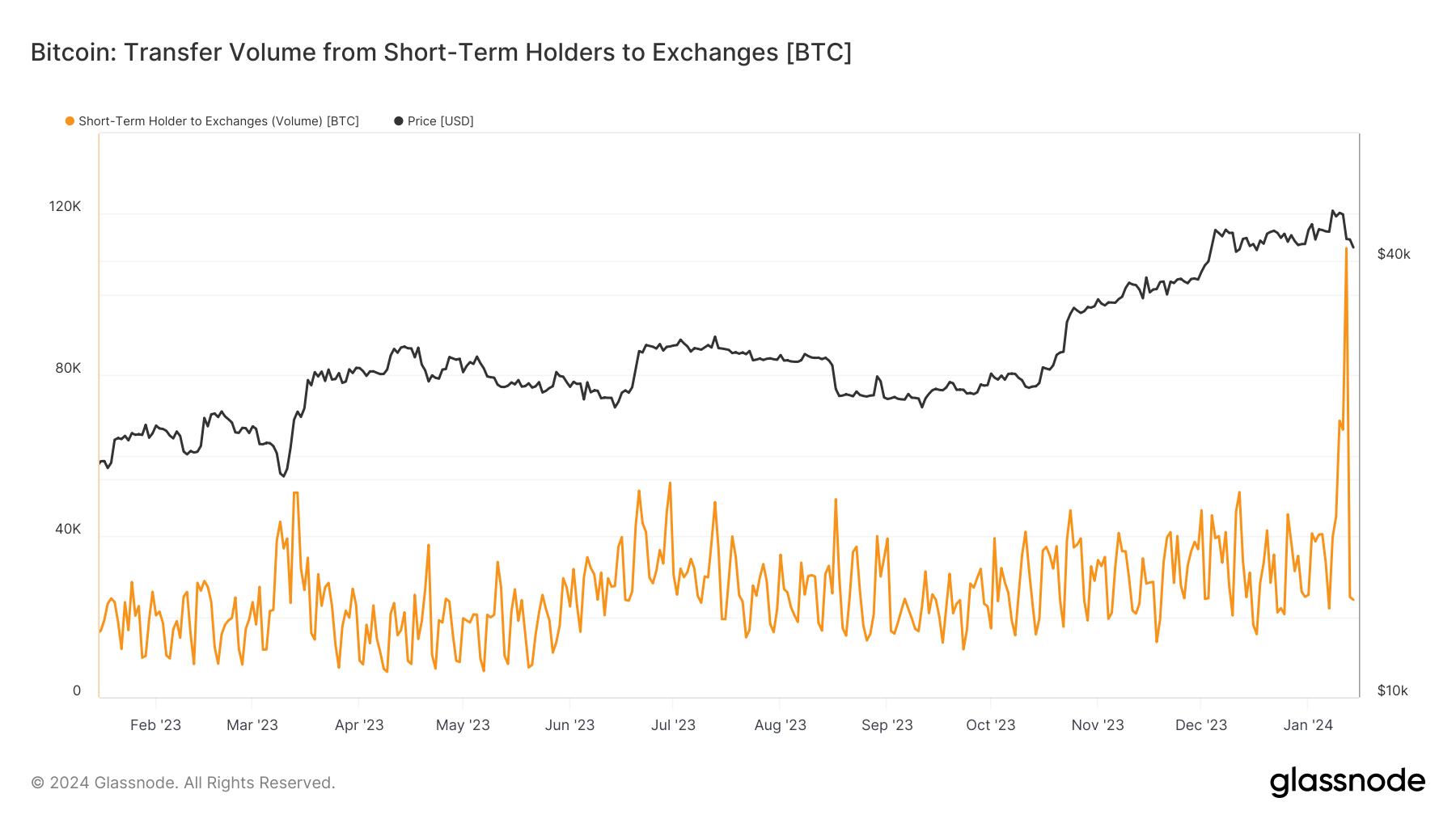

The activities of short-term holders, particularly their transactions to exchanges, show where most of the volatility came from. A significant increase in the volume of Bitcoin sent to exchanges was observed, particularly on Jan. 12, when short-term holders transferred 111,476 BTC to exchanges, marking the highest level since May 19, 2021. This spike indicates a considerable sell-off by addresses that have held their BTC for less than 155 days.

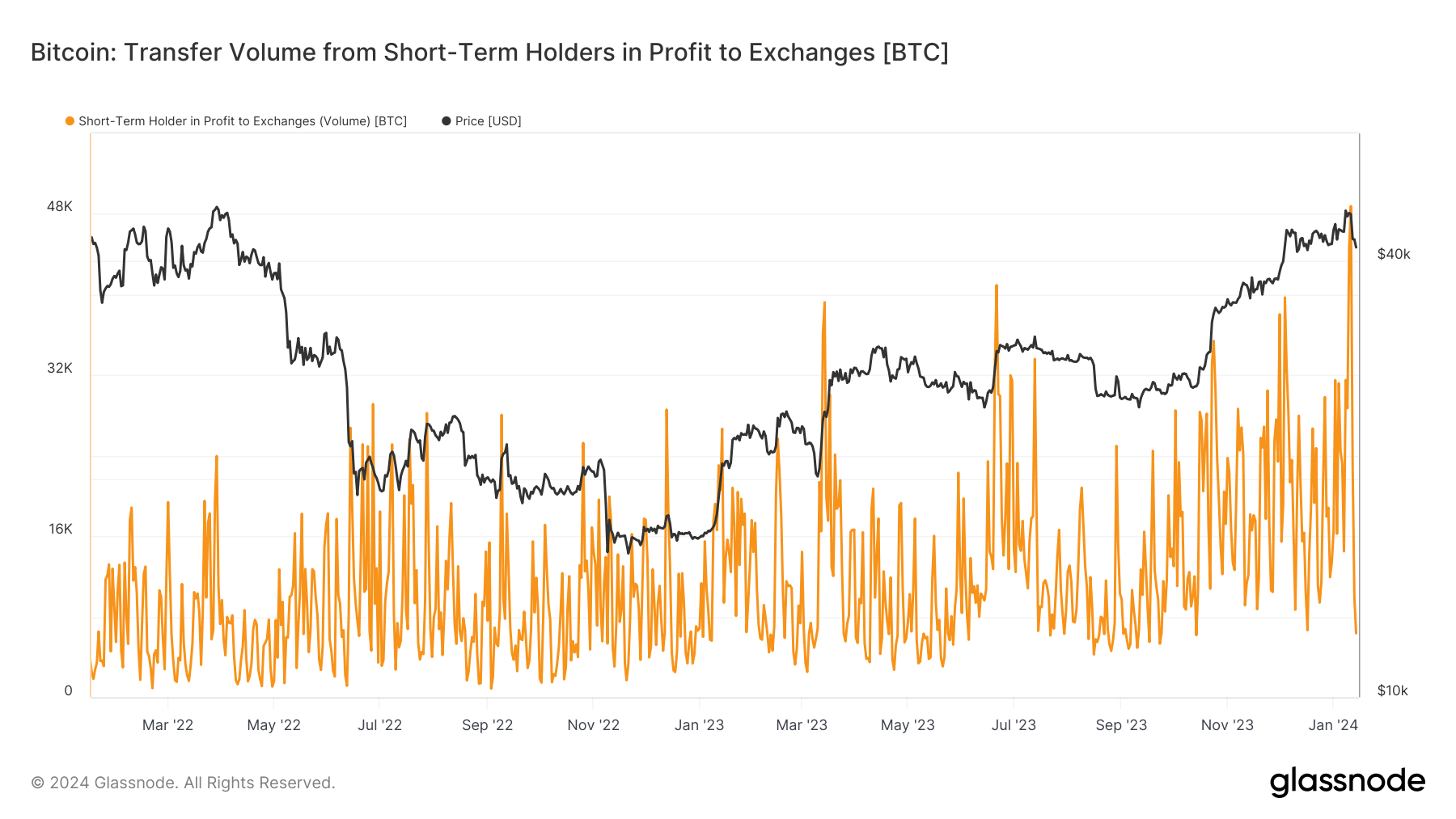

Further analysis of short-term holders’ positions in profit and loss shows the extent of profit-taking during the volatility. On Jan. 11, the volume of Bitcoin held by short-term holders in profit sent to exchanges reached its peak.

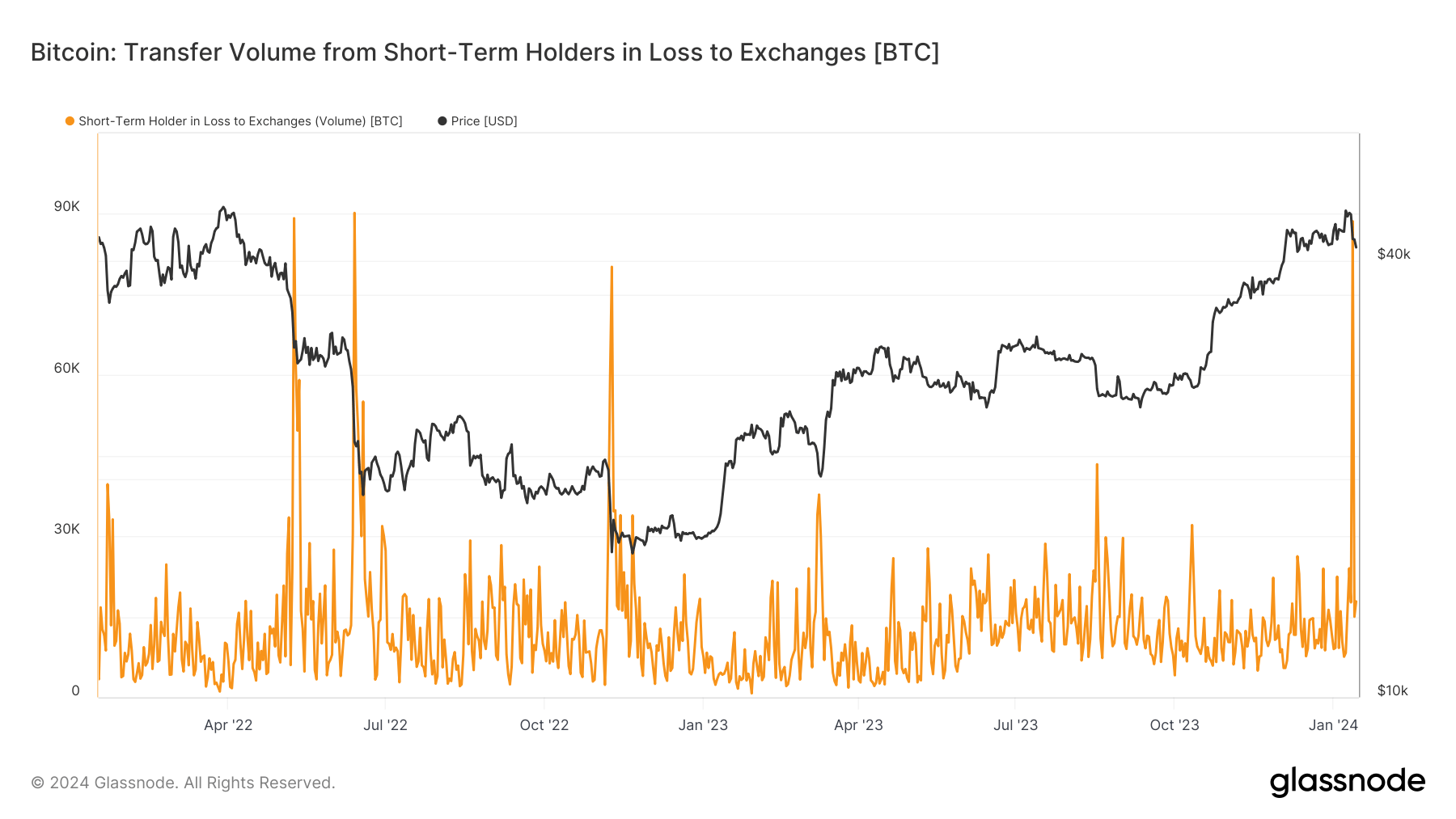

Conversely, the following day saw a peak in Bitcoin held by short-term holders in loss being transferred to exchanges. These movements suggest a quick shift in market sentiment — from taking profits to cutting losses — as the price started to fall.

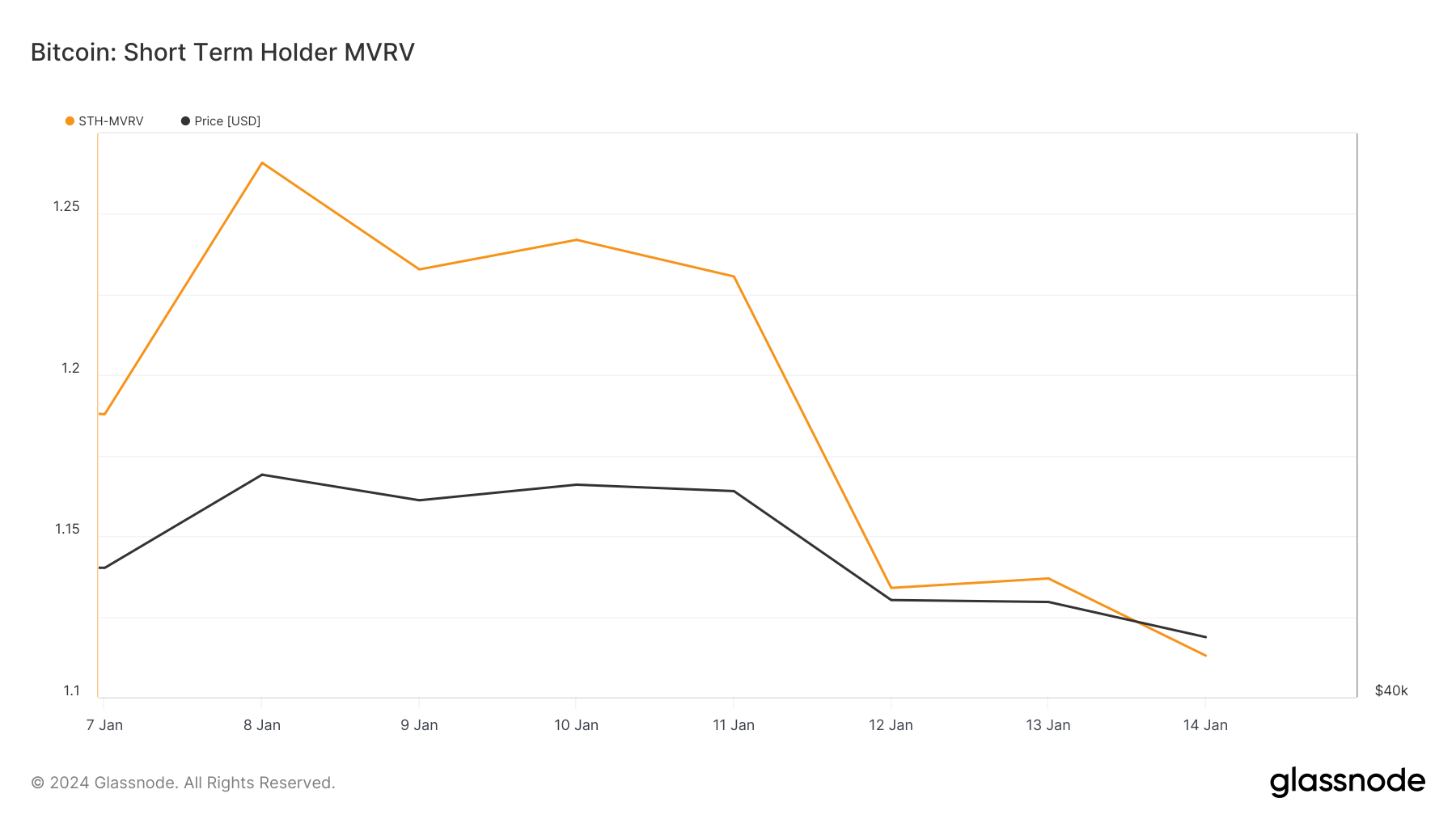

The Market Value to Realized Value (MVRV) ratio helps us understand the profitability of these short-term holdings. MVRV compares the market value (the price at which BTC last moved) with the realized value (when BTC was last bought).

Typically, a high MVRV ratio suggests that holders are in profit and may be inclined to sell, while a lower MVRV indicates minimal profit or losses. During this period, the MVRV ratio saw a downward trend, reflecting a decrease in the profitability of short-term holdings, potentially contributing to the selling pressure observed in the market.

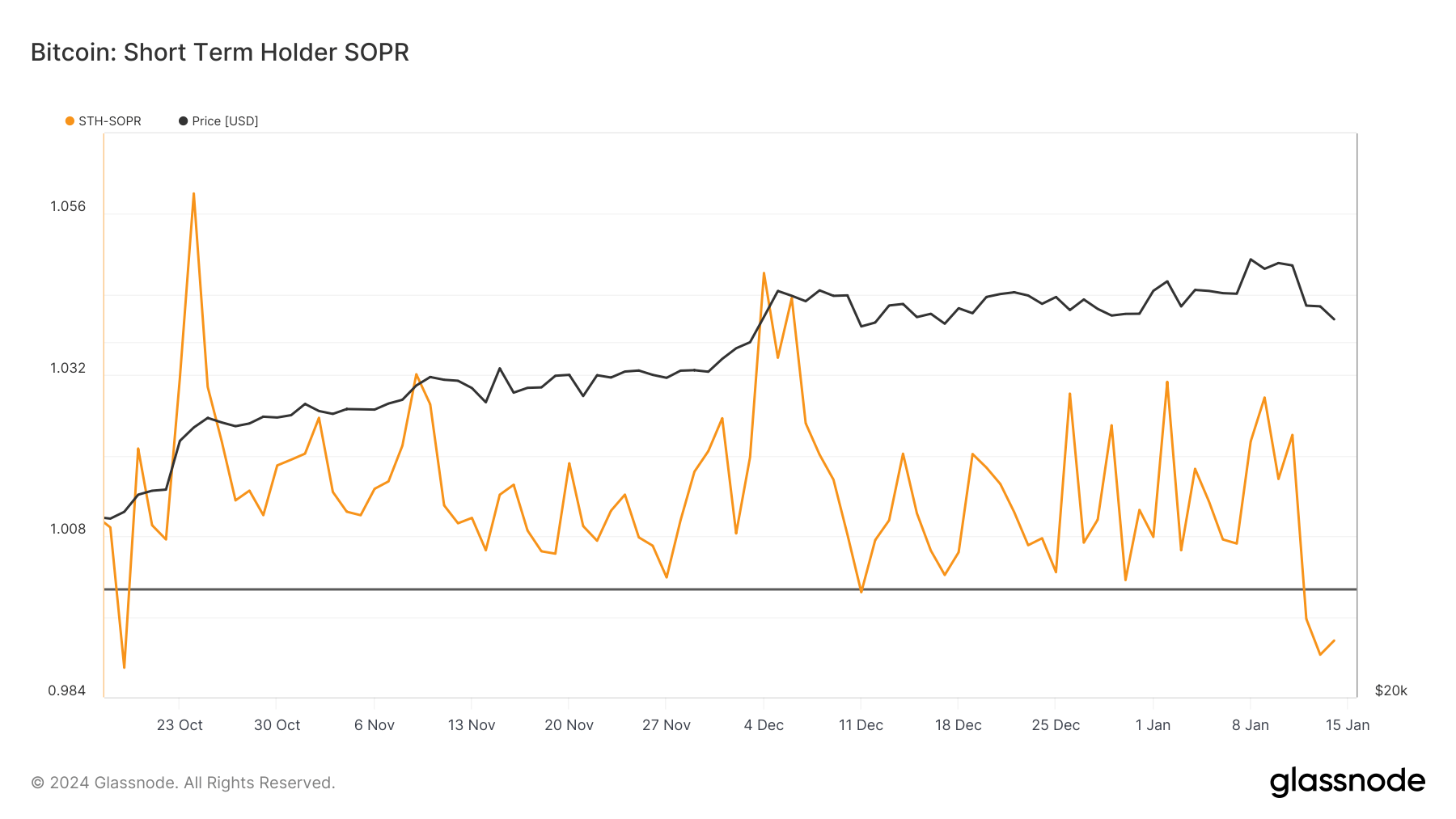

Another pivotal on-chain metric is the Spent Output Profit Ratio (SOPR), which assesses the profit ratio of spent outputs. When the SOPR is above 1, it implies that coins are being sold at a profit. In contrast, a SOPR below 1 indicates that coins are sold at a loss.

Notably, the short-term holders’ SOPR fell below 1 on Jan. 12 and 13. This is significant as it signals a change in market sentiment, with holders likely selling Bitcoin at a loss in response to the declining prices.

The short-term data surrounding the SEC’s approval of the first spot Bitcoin ETFs reveals a Bitcoin market that is highly reactive to regulatory developments. The initial positive anticipation of the approval quickly shifted to panic, characterized by the substantial sell-off from short-term holders.

This behavior is reflected in the significant amount of Bitcoin moved to exchanges, especially on Jan. 12, and the declining MVRV ratio. The drop in the SOPR below 1 shows how quickly and aggressively short-term holders react to market volatility.

The post Short-term holders drive Bitcoin’s post-ETF volatility appeared first on CryptoSlate.

[ad_2]

Source link