[ad_1]

The crypto market is currently charged with tension, anticipating the U.S. Securities and Exchange Commission’s impending decision on the first spot Bitcoin ETF. Amidst divided opinions over whether the SEC will approve the ETF in the coming days or postpone the decision again, a close analysis of Deribit’s Bitcoin options market reveals traders bracing for considerable price movements in January.

As of Jan. 5, the total open interest in Bitcoin options on Deribit is 228,646.70 BTC, representing a notional value of $10.05 billion. This substantial figure indicates a high level of market participation and interest in Bitcoin’s future price movements.

The dominance of call open interest, comprising 162,694.50 BTC compared to put open interest at 65,952.20 BTC, suggests a bullish sentiment among investors. They appear to be anticipating or hedging against a potential increase in Bitcoin’s price.

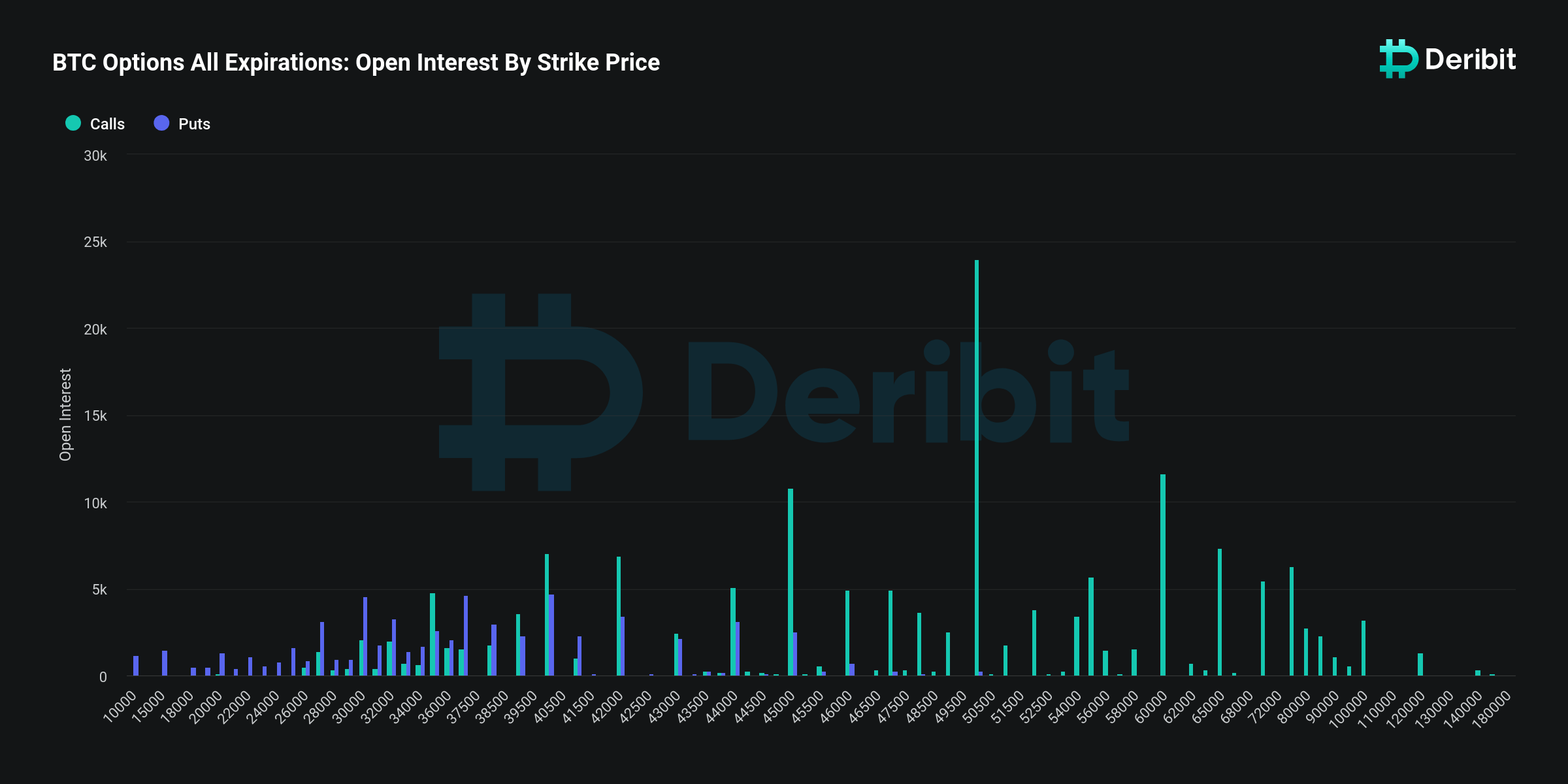

The breakdown of open interest by strike price further reinforces this bullish sentiment. The highest concentration of call options is at the $50,000 strike price, with a value of $1.05 billion. This level could be viewed as a significant psychological and financial threshold that many investors are betting Bitcoin will reach or surpass. The next highest concentration is at the $45,000 and $60,000 strike prices, indicating optimism for even higher prices, though with lesser conviction than for the $50,000 mark.

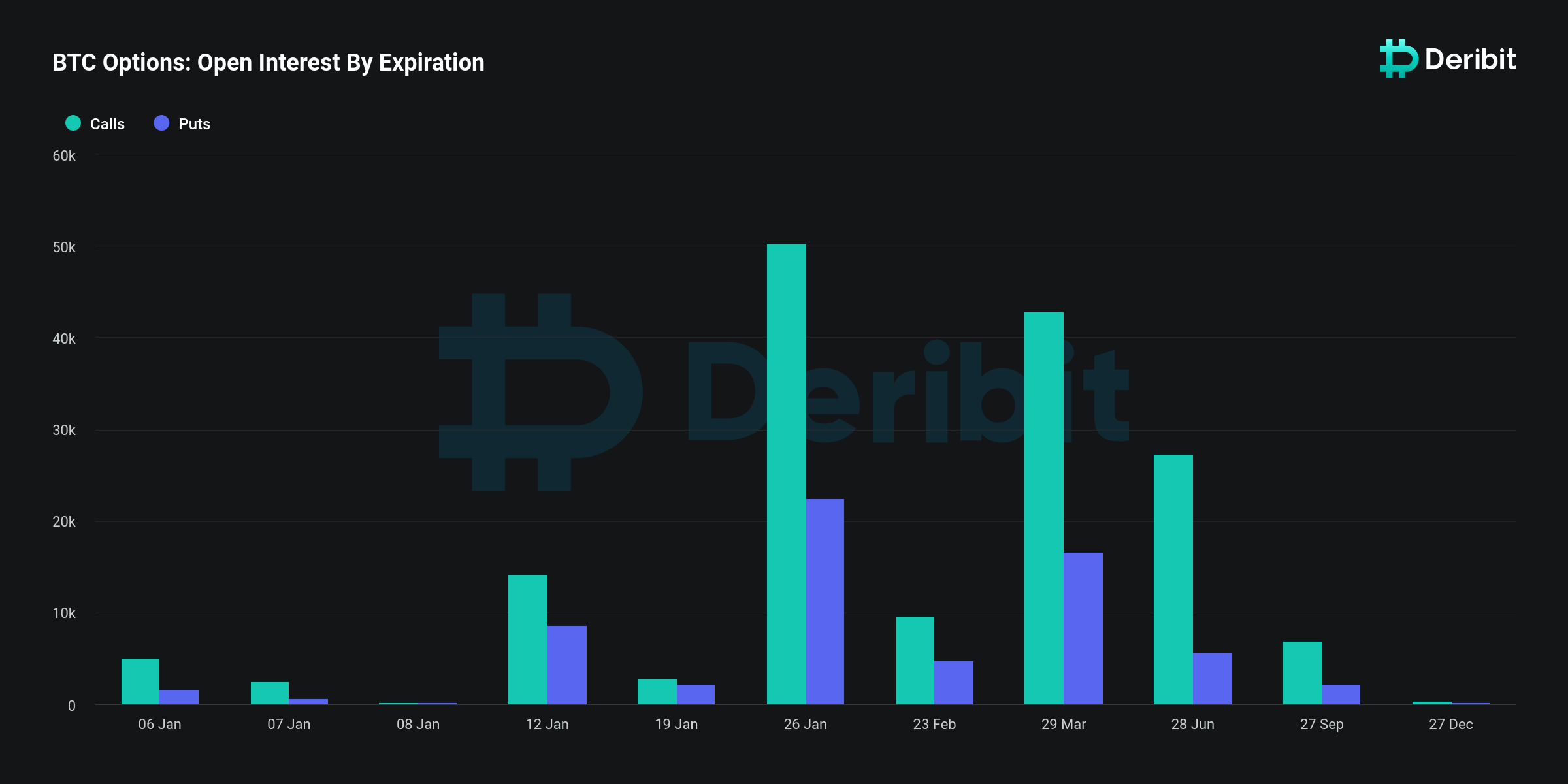

Regarding open interest by expiration, the data shows a heavy concentration of call options for the Jan. 26 expiration, with $2.21 billion in calls versus $988.49 million in puts. This suggests that the bullish sentiment is more pronounced for the medium term, with a large part of the market anticipating significant developments surrounding the Bitcoin ETF to occur before this date.

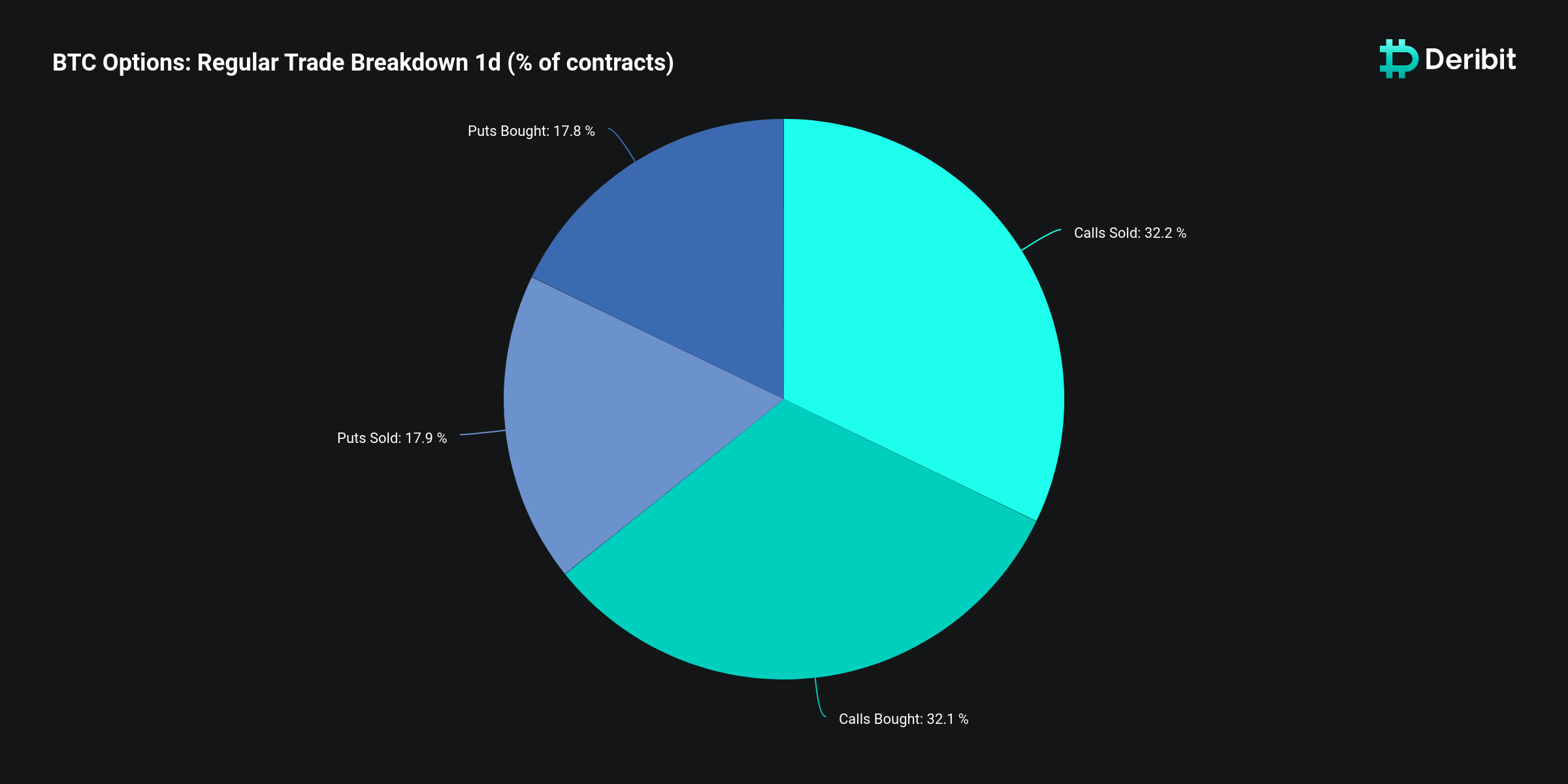

The regular trade breakdown, showing almost equal percentages of puts and calls bought and sold —17.8% and 17.9% for puts, 32.1% and 32.2% for calls, respectively — indicates a balanced market in terms of trading activities. The data shows that a higher percentage of market participants are engaged in call option transactions compared to puts. This indicates a stronger interest in betting on or hedging against an increase in Bitcoin’s price. The balance between calls bought and sold is also nearly equal, suggesting that for every investor speculating on a price rise (by buying calls), there is almost an equal number of investors (or perhaps the same investors in different transactions) who are either more cautious or looking to profit from selling these options.

Data from Deribit reflects a predominantly bullish sentiment, with investors showing a strong belief in the potential for Bitcoin’s price to increase, particularly towards the $50,000 level in the short to medium term. However, a substantial amount of put options and balanced trade activities indicate a cautious approach among traders, with many preparing for further volatility.

[ad_2]

Source link